What’s the difference between an ETF and a Managed Fund?

Exchange traded funds (ETFs) and managed funds are both made up of large amounts of different assets.

Investing in ETFs and managed funds makes it easier for you to gain exposure to a large range of assets and diversify your portfolio, without you having to do the heavy lifting of researching and trading each individual asset yourself.

Key differences between ETFs and Managed Funds:

👉 ETFs are listed on centralised stock exchanges but managed funds are not.

👉 ETFs are mostly passively managed and designed to track and underlying index (ie The S&P 500). Managed funds are typically actively managed, with the goal to outperform and index.

👉 ETFs typically have lower fees than Managed funds. Both ETFs and Managed Funds charge management fees, but Managed Funds may also charge and additional performance fee if the fund turns a profit.

Advantages of ETFs

Pricing visibility

Since ETFs are listed on centralised exchanges, it’s possible to see the price of your investment throughout the day. With managed funds, the price of your investment is reported less frequently, on a daily, weekly or even monthly basis.

Liquidity

By being listed on centralised exchanges, ETFs can normally be brought and sold during the day at the current trading price. With managed funds, investors typically need to wait until the end of each day or longer to trade their holdings.

Low fees

ETFs are often passively managed, which means you don’t incur performance fees to cover the cost of the fund manager actively managing your money.

Advantages of managed funds

Simplified taxation

In NZ, most managed funds are Portfolio Investment Entity (PIE) funds. When you invest in a PIE, it’ll pay tax on your behalf. Also, tax on income PIE funds is capped at 28%, which is an advantage if you are currently in a higher income tax bracket of say 33%.

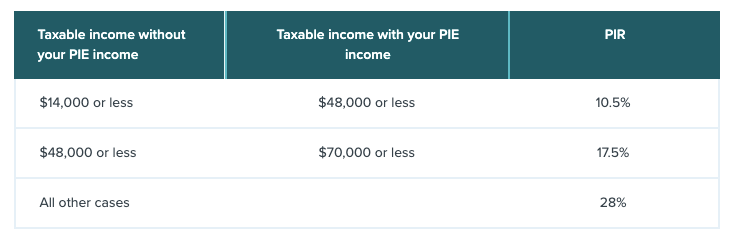

Multi-rate PIEs allow investors to be taxed according to their prescribed investor rate (PIR), which is especially attractive if you fall under the 10.5% of 15% tax bracket. The table below shows the income amounts that qualify you for each PIR in a tax year.

With ETFs, tax can be a little more complicated. When you invest in overseas based ETFs, you’re often expected to pay your own taxes, which can take a bit more time and effort to get a handle on.

This being said, some platforms such as InvestNow and Sharesies offer another form of ETFs called listed PIEs, which are taxed at 28%. This tax is managed by the fund provider, which can make things a lot easier.

At the same time, the fixed 28% tax rate on listed PIEs can be a disadvantage if your PIR rate qualifies you to be taxed at 10.5% or 17.5%, as you’ll be paying more tax than you need to on the listed PIEs - which means you’ll end up having to claim this tax back at the end of the tax year if you want to see the money again.

One of the most attractive things about investing in ETFs and Managed fund is that many allow you to take a “set and forget” type approach.

But before diving in, remember to pay attention to some of the conditions of each fund type, such as taxes and fees ✌️

Thanks for reading! Feel free to subscribe for a fortnightly delivery of tips and tricks for starting a group investment fund, along with a bunch of extra great educational resources and summaries on different investments that Mates Rates Capital are looking at.

About us

Here at Mates Rates Capital, we’re just a group of mates trying our hand at investing by pooling together a small amount of our hard earned wages each week.

We started Mates Rates Capital as a project to share our tips, tricks, mistakes, and learnings so that you can go start a group investment fund and reap the rewards of investing with friends.

Come along for the ride! 🤙

Please note, all information shared by Mates Rates Capital is intended for educational purposes only and should not be be treated as financial advice. If you have questions or concerns regarding tax it please run these by a registered financial advisor or accountant.